28+ Stock Average Cost Calculation

You can use this WACC Calculator. The figure can be calculated for each class of stock.

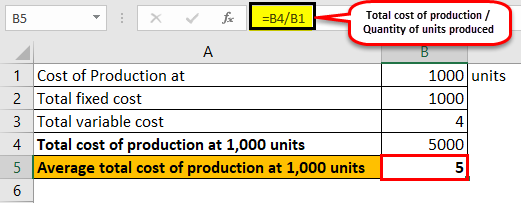

Average Total Cost Formula Step By Step Calculation

They may also be referred to as tax lots A lot is one stock trade.

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

. Stock profit current stock price - cost basis n. The average cost method formula is calculated as. Lets say you buy 100.

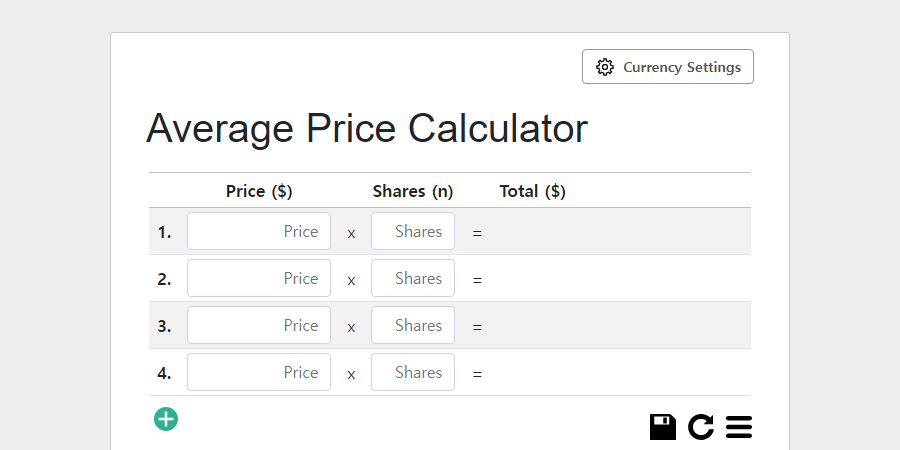

You can use an average cost calculator to determine the average share price you paid for a security with multiple buys. Dividing the sum of total cost by the number of the total shares. Weighted Average Cost of Capital WACC is the rate that a firm is expected to pay on average to all its different investors and creditors to finance its assets.

The formula for averaging down for any investment is to divide the total cost of your position by the number. Enter the share price of the first stock. Total Cost of Goods Purchased or Produced in Period Total Number of Items Purchased or Produced in Period Average.

Heres the formula. Then Stock profit 100 USD - 7992. To get the average cost list the number of shares purchased and the cost of those shares for each lot.

There are three primary columns on the calculator - Stock Shares Price Per Share and Subtotal. Average stock is arrived at using the following formula. Enter the number of shares you currently have and price per share on the.

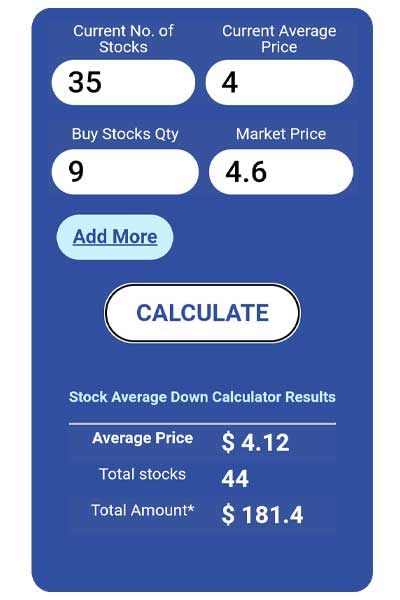

How Do You Calculate The Cost Basis Of Stock With Multiple Purchases. To calculate the average stock price of every stock in your portfolio you can take the following steps. Averaging down is an investment strategy that involves buying more of a stock after its price declines which lowers its average cost.

This application allows to calculate stock average on entering first and second buy details. Specify the Capital Gain Tax rate if. The cost basis of 2853 is the reference point.

They assumed theyd owe tax on 38250 in gains if they did. This can be handy when averaging in on. What is the formula for averaging down in stocks options or crypto.

Last week Tony bought a cryptocurrency coin called ADA Cardano. Gospodarek describes clients who spent 1750 on 200 shares of stock in 1987 and could sell now for 40000. To calculate the cost of multiple shares purchased simply add the individual cost basis for each share you own.

How To Calculate DCA. Enter the purchase price per share the selling price per share. It works out to 2853.

The average cost basis is defined as the total purchase amount divided by the total number of shares. Just follow the 5 easy steps below. The Stock Calculator is very simple to use.

Using the average down calculator the user can calculate the stocks average price if the investor bought the stock differently and with other costs and share. First enter the share. Lets say that AMD stock rose to 100 USD per share today.

Average Stock Opening Stock Closing Stock 2.

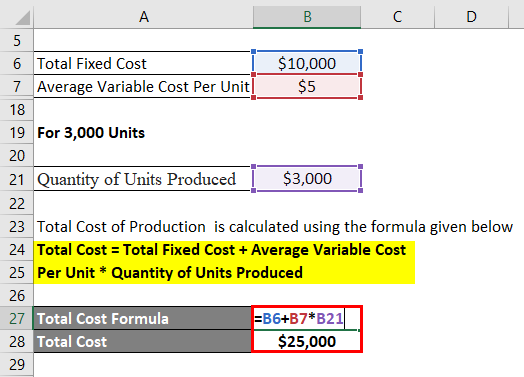

Average Total Cost Formula Step By Step Calculation

Ex 99 1

:max_bytes(150000):strip_icc()/stocks-lrg-2-5bfc2b1d46e0fb0051bdcc6a.jpg)

Peer Comparison Uncovers Undervalued Stocks

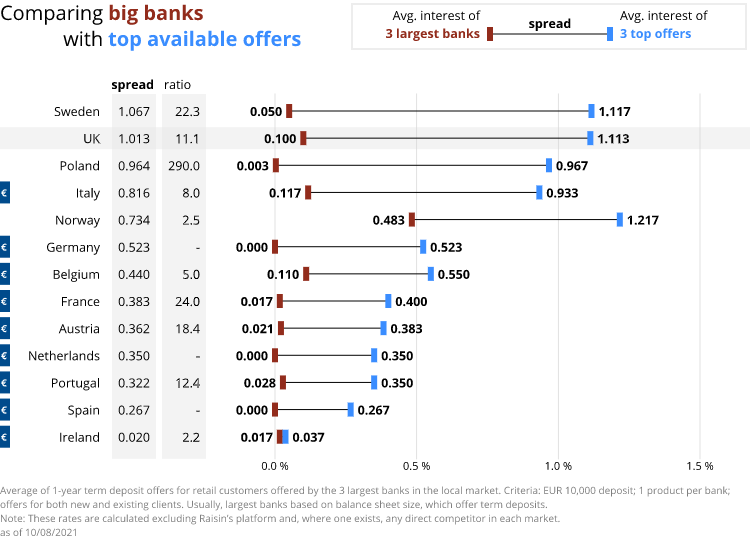

Interest Rates Explained By Raisin

Interest Rates Explained By Raisin

Airbnb Completely Additive By The Science Of Hitting

Stock Average Calculator Marketbeat

Online Average Calculator Free Stock Average Calculator

Stock Average Price Calculator Fical Net

Inventories And Cogs Final Pdf Cost Of Goods Sold Inventory

Total Cost Formula Calculator Examples With Excel Template

Phillips Edison Company Reports Fourth Quarter And Full Year 2019 Results Business Wire

Which Stock Is Next Mrf In Indian Stock Market Quora

Calculation Allocation For Seedling Cost Per Year Download Scientific Diagram

City Of Hobart Annual Report 2021 22 By City Of Hobart Issuu

How To Calculate Your Average Cost Basis When Investing In Stocks Youtube

Stock Average Price Calculator Apps Bei Google Play